USD to Paraguayan Guarani Rate Hits 500 Amid Market Shifts

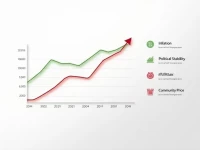

This article analyzes the current exchange rate information for converting 500 US dollars to Paraguayan guaraní (PYG), noting that 500 dollars can be exchanged for approximately 3,749,661 guaraní. It provides statistical data on recent exchange rate fluctuations and offers a brief overview of the basic situation regarding the US dollar and guaraní.